A Wonderful Business at a Fair Price - Can we explain Fair Value Better ?

- Mar 14, 2022

- 3 min read

Updated: May 29, 2022

We share a valuation framework to help Business Owners confidently explain the value of their businesses.

Casually using a Price-to-Earnings Ratio is not the best idea if you want to value your business for sale

When it comes to valuing a company, many people use rule of thumbs such as earnings multiples or they would capitalise the company earnings using an average capitalisation rate. Some take the extra step to do a discounted cashflows calculation to justify the valuation.

All these are great until it isn’t.

Warren Buffet did say that it is better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Business owners naturally would want to value their companies as high as possible. However, is the high valuation considered fair? If business owners can quantitatively justify how the valuation is fair, it will help bridge the valuation expectations gap between buyers and sellers. This would also increase the chance of successfully selling the business.

As valuation specialists, we see the value of a company in a different way. Hence, we do not believe that simply using an earnings multiple from Google is a good way to arrive at fair value. This method is fast and cheap but is ineffective. We think that the amount of time spent on valuing a company is proportional to how much we understand the value drivers of the company.

It breaks our hearts to see how often the valuation of the company is arrived at as an afterthought and then buyers and sellers get emotional about the valuation being too high or too low. The valuation of a company first and foremost must be calculated in a logical and systematic way.

Think of how the intangible and tangible assets drive business value

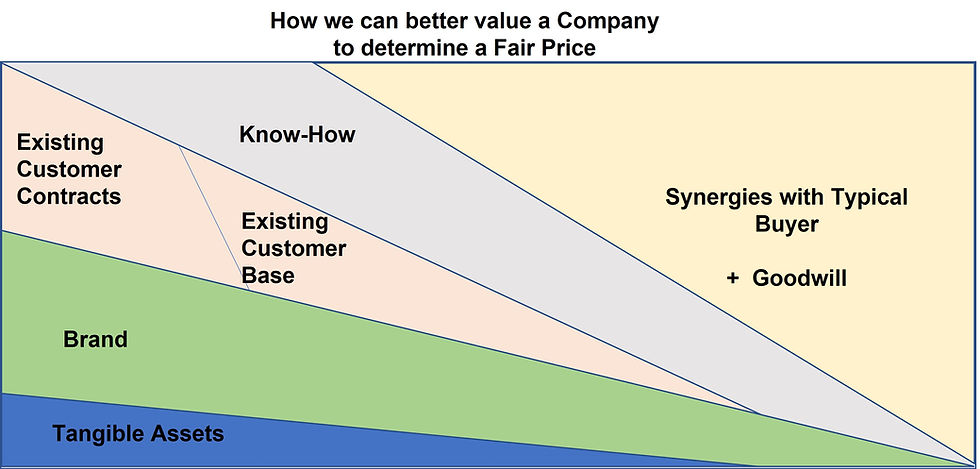

Today we want to share a framework of how we would calculate the value drivers in a company valuation. These building blocks can then help the business owner justify why the asking valuation is fair. With a company valuation that is fair and well thought through, the business owner (seller) can walk away from a low-ball offer with peace of mind. Also, the seller can explain more confidently to the buyer why the business is worth its worth.

Our framework can be summarised into a picture:

To the acquainted, this is your familiar purchase price allocation for financial reporting which the buyer needs to do after acquiring a company. We have found this framework to be incredibly useful for the business owner (seller) too. With this valuation framework, we can easily quantify the value of the intangible assets and synergies. Synergies is often the reason cited for buying a company. However, nobody talks about the difficulties of realising these synergies.

Understanding how much of the business value is from synergies which can be difficult to actually achieve

If the business owner can clearly explain that only 20% of the valuation is driven by synergies and 80% is driven by the existing intangible assets and expected cashflows of the company, we think this is a much more confident story about the business.

Do not forget that the seller will also value the company using his own assumptions. And if the seller is undervaluing the intangible assets of the business or is understating the possible synergies, the buyer can either walk away or highlight to the seller the valuation gaps to justify for a fair value.

Based on our experience, we see business owners being great in running their business but sometimes lost about the true value of their company.

A professional and independent valuation which is well thought through always sets the record straight.

Comments